Whenever you travel to any country, you must always go through customs procedures before you can enter. This is a crucial aspect of traveling and Japan is no exception. The following information comes directly from Japanese Customs data.

These are typical regulations everyone must abide by. However, if you have plants or live animals, you must first visit a quarantine officer to inspect these before you can begin your customs process.

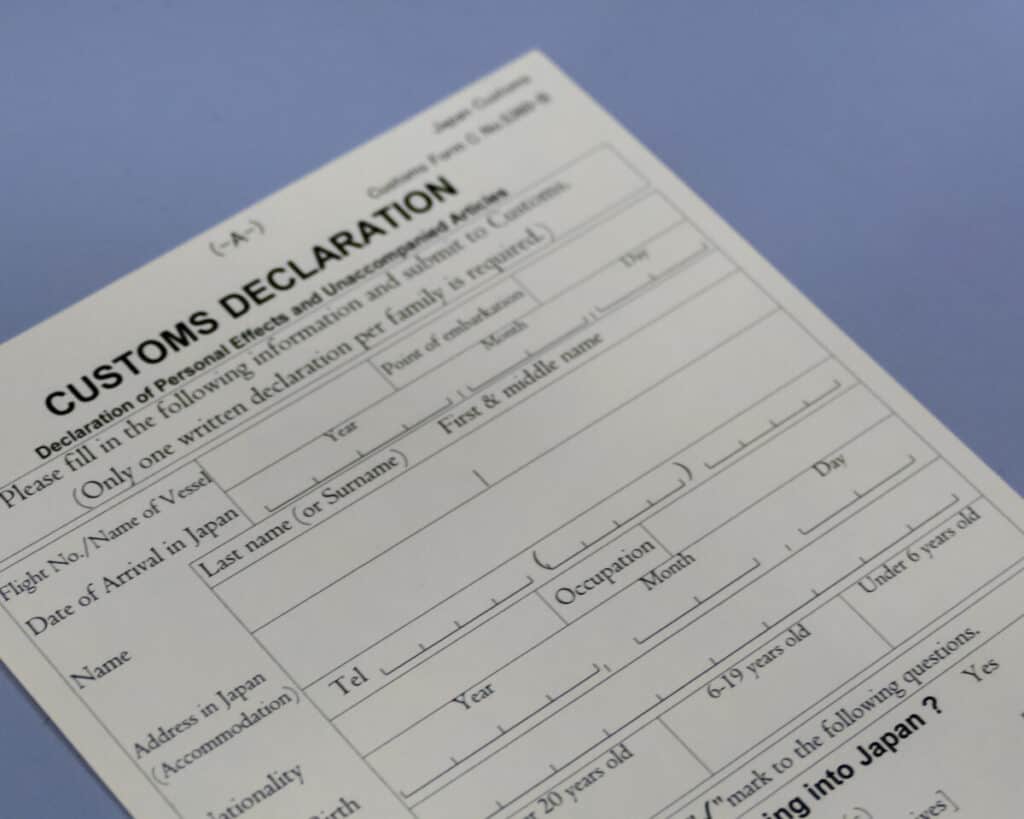

Written Declarations

When you collect your luggage after disembarking a boat or plane, you will have to visit customs before you can enter the country. Here, you may have to provide a written declaration of all the belongings you have.

You must provide two copies of this form if there’s baggage not accompanying you. The customs officer will return one of these copies to you with their certification seal. You will not be able to get duty and tax exemptions without it.

Unaccompanied Baggage

Any unaccompanied baggage must be in your possession within six months of your arrival. When the items come, you must present this document to clear its entry.

If shipping items by mail, you must list these on your declaration and identify the parcel with the certified customs document. Also, you must write on the parcel prior to shipping “unaccompanied baggage.”

Duties And Taxes

All customs declaration forms will be available on your flight as well at the customs office. Once you have your documents and declarations ready, you will have to choose one of two lanes: green or red.

The green is for those who don’t have any items subject to duties, taxes and are free of import restrictions. The red is for all other passengers that have things they must claim for duties and taxes.

Once a customs officer accounts for the items requiring taxes and duties, you will have to pay these at the bank located in the customs office on the premises. However, if the total value of your taxes and duties exceeds ¥300,000 ($2,580 USD), then you must undergo procedures for commercial cargo.

Personal Effects and Professional Equipment

Personal effects and unaccompanied baggage are free of duties and taxes so long as they are within a specific and reasonable amount.

This generally means anything that’s under ¥10,000 ($86 USD) in market value will not incur a duty or tax. The following list details everything that is exempt from such fees.

- Toiletries

- Clothing

- Headphones

- Notepads ; Pens

- Cameras (video and photo – so long as you use it for your stay in Japan)

- Perfume (up to two ounces)

Food, Beverages, Tobacco

- No more than 100 grams of rice

- Alcohol (up to 3 bottles totaling 760cc)

- Tobacco (no more than a total of 250 grams = 200 cigarettes, 50 cigars or 10 packs of other tobacco)

If the overall market value of any other effects than the ones listed above exceeds ¥200,000 ($1,720 USD), then duties and taxes are due based on the amounts over the acceptable limit.

Household Possessions

For those moving to Japan, there will surely be household items coming along. There are special exceptions but most are duty and tax-free.

However, for bigger ticket items such as cars and boats, you will need to present your sales receipt, registration, and any other official documentation.

These are duty-free, however. But the caveat is that you must export them when you intend to leave.

- Automobiles

- Boats

- Appliances

- Bedding

- Tables ; Desks

- Chairs, Couches, Love Seats and etc

Items that Incur Duties or Taxes

Anything valued over ¥200,000 ($1,720 USD) that you don’t intend for personal use will have duty and tax fees.

So things like commodities and commercial samples will have a fee because these are for the public and are therefore not personal use.

Rice that falls outside of this acceptable amount will require a “Report for the Import of Rice” to the customs office.

For personal consumption items that exceed the allowed reasonable limit, they are subject to a 15% duty charge. The following itemizes these and the fee they incur.

- Whisky or Brandy: ¥800 ($6.88 USD) per liter

- Vodka, Gin or Rum: ¥500 ($4.30 USD) per liter

- Other Liquor: ¥400 ($3.44 USD) per liter

- Distilled Alcohol: ¥300 ($2.58 USD) per liter

- Beer, Wine ; Similar Alcohol: ¥200 ($1.72 USD) per liter

- Cigarettes: ¥15,000 ($129 USD) per 1,000 cigarettes or ¥15 ($0.13 USD) per cigarette

Currency

Customs requires all foreigners to fill out a “Declaration of Carrying a Means of Payment” if the amount of currency on their person (or unaccompanied baggage) exceeds ¥1 million ($8,600 USD). This includes cash, coins, traveler’s checks, promissory notes, and securities.

For metal bullion, like gold and silver, there is a duty-free and tax-free allowance. Anything pure over 90% and weighing less than 1 kilogram is allowable without incurring any fees.

Regardless of the gold’s purity and weight, however, if it exceeds ¥200,000 ($1,720 USD) in value, you must fill out the “Declaration of Personal Effects and Unaccompanied Articles” form.

Unless you are on your way to North Korea, then you must claim anything exceeding ¥100,000 ($860 USD). Also, note that you cannot transport metal bullion into that country.

Prohibited or Restricted Items

As with most countries, you can’t have illegal contraband. Things like marijuana, heroin, methamphetamine, cocaine, MDMA, stimulants, or any psychotropic and narcotic drugs are not permissible. If you bring these in, you risk arrest which usually involves subsequent deportation.

Exceptions for Cosmetics, Drugs or Medications

The only exception is if you have a designated prescription from your doctor or permission from Japan’s Ministry of Health.

Getting permission from the Japanese government for drugs and substances must have a provable medical value. There are certain cosmetics that will fall under this restriction as well.

Having said that, you can have cosmetics that allow for up to 24 applications and medications cannot exceed more than a two-month supply. Beyond those amounts, you have to get permission from the Ministry of Health, Labor, and Welfare.

Firearms or Other Weapons

Likewise, you cannot bring firearms, pistols, shotguns, rifles, ammunition, or any parts for firearms thereof. This also includes things like detonators, explosives, and precursor materials for chemical weapons.

However, you can obtain a permit for weapons like hunting rifles, swords and archery. You will have to prove what you intend to use the weapon for while in the country.

Other Prohibited Items

There are other prohibited items to notes as well such as counterfeit, altered or imitation money. Even if it’s for a game like Monopoly, you cannot bring fake money in any form with you into Japan.

Also, pornography is absolutely prohibited as well as any other literature deemed obscene, immoral or hurtful to public safety. Such limitations also apply to things that infringe upon intellectual property rights.

Purchases Made in Japan

If you make purchases while in Japan when you leave, ship them back home. You will be able to avoid the consumption tax you will have to pay before you leave.

Japan Customs Official Website

All you have to do is present your receipt for the item you bought and the receipt for its shipment home.